In 2025, the pump industry is transitioning from isolated technological breakthroughs to comprehensive system integration.

In 2025, the global pump industry is entering a pivotal phase of technological integration and market restructuring, driven by the dual objectives of carbon peaking and carbon neutrality, alongside the accelerated advancement of Industry 4.0.

According to the annual report of the International Fluid Machinery Association, the global centrifugal pump market has reached $65 billion, with a year-on-year growth of 7.2%. Among them, the China market contributed 25% of the share, and the high-end market share increased by 6 percentage points.

1. Macro Drivers of Technological Innovation

The pump industry's technological innovation in 2025 is being strongly propelled by multiple macro factors. The ongoing progress of the' dual carbon 'goals and the deep integration with Industry 4.0 jointly form the core driving force for the sector's development.

Policy frameworks are driving transformative changes: The EU has implemented the MEI amendment under Regulation 547/2012, while the U.S. Department of Energy maintains stringent energy efficiency thresholds for industrial pumps. These mandatory standards are reshaping the competitive landscape of the global pump industry.

In terms of technological advancement, the convergence of artificial intelligence (AI), the Internet of Things (IoT), and materials science is continuously expanding the intelligent boundaries of pump equipment. AI-driven systems can provide early warnings for potential failure risks such as impeller wear and shaft seal leakage, significantly reducing equipment failure rates.

The global pump market demonstrated robust performance, with the Asia-Pacific region standing out notably. The regional market size reached $17.7 billion in 2024 and is projected to grow from $18.6 billion in 2025 to $30 billion by 2034, at a compound annual growth rate (CAGR) of approximately 5.4%.

2. Advances and Breakthroughs in Core Technologies

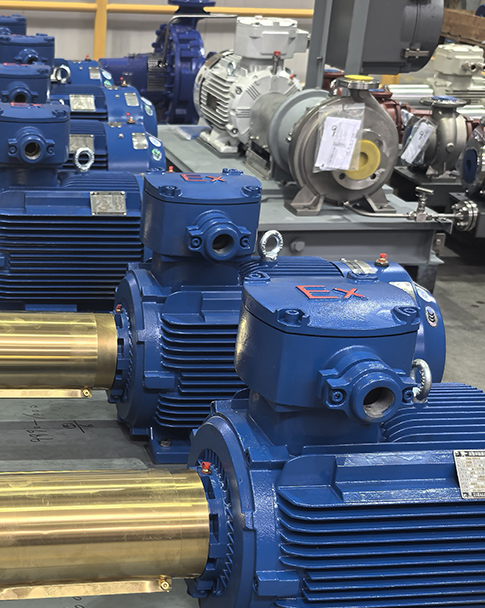

In 2025, the pump industry is transitioning from isolated technological breakthroughs to comprehensive system integration, with four core technologies now achieving large-scale implementation.

In the application of new materials, the large-scale adoption rate of silicon carbide (SiC)-reinforced impellers and corrosion-resistant alloy pump shafts has reached 68%. Silicon carbide (SiC) impellers demonstrate significant advantages in harsh industrial environments due to their excellent comprehensive performance, specifically manifested in:

1) Exceptional corrosion resistance: Capable of withstanding strong acids, strong alkalis, and oxidizing media, with performance far surpassing traditional metal materials like stainless steel.

2) Exceptional wear resistance: With a hardness comparable to diamond (Mohs hardness 9.5), it is ideal for high-wear applications like pulp conveyance, offering a service life 5-10 times longer than metal impellers.

3) Exceptional high-temperature stability: Maintains mechanical properties below 1600°C, making it suitable for high-temperature fluid transportation.

4) Lightweight design: With a density of approximately 3.1 g/cm³, it is lighter than metal, reducing the inertia of rotating components and enhancing system energy efficiency.

5) Low thermal expansion coefficient: Excellent thermal shock resistance, suitable for environments with rapid temperature changes.

6) Structural innovation enhances reliability: Novel designs such as modular splicing and internal cavities improve the impact resistance and manufacturing yield of large impellers; certain patented technologies employ metal inserts to strengthen connection integrity, effectively mitigating the risk of ceramic-metal interface failure.

In the field of wear-resistant materials, the WC20Cr3C27Ni coating fabricated using HVOF and APS processes can enhance the substrate's slurry erosion resistance by 3.5 times.

Digitalization and intelligentization have emerged as key innovation drivers. The adoption rate of AI-powered O&M systems has increased by 40% year-on-year, with leading brands now widely implementing features like fault prediction and energy efficiency monitoring.

Modular and customized design has become crucial for addressing complex demands. For instance, Swiss company Wandfluh leverages an AI-assisted design platform to reduce the shortest delivery time for customized services to just 4 days.

Breakthroughs continue to be made in extreme condition adaptation technologies, with representative products now achieving stable operation across a wide temperature range from-60°C to 500°C.

3. Technical Path and Application Analysis

Table: Key Technological Pathways in Pump Industry for 2025 and Their Applications and Commercial Impacts

|

Technical Path |

Core Technological Breakthroughs |

Typical Application Scenarios |

Commercial Value & Market Impact |

|

High-efficiency Energy-saving Technology |

Carbonization Rotor |

Municipal Sewage Treatment, Seawater Desalination |

Significantly reduces maintenance and energy costs |

|

Intelligent Operation & Maintenance |

HT-AI Platform (predictive maintenance accuracy: 99%), Digital Twin Technology |

Large-scale Power Plants, Nuclear Power Plant Cooling Systems |

Greatly reduces planned downtime losses |

|

Extreme Customization |

Wide-temperature Adaptability Technology (covers -60°C to 500°C) |

Deep-sea Oil & Gas Drilling, Natural Gas Transportation |

High-end customized orders grow rapidly; customer satisfaction rises |

|

Corrosion & Wear Resistance Technology |

PTFE Multilayer Composite Coating (corrosion resistance increased by 50%), Superhard WC Coating |

Chemical Process Treatment, Mine & Metallurgy Transportation |

Significantly improves market share in harsh working environments |

Energy-efficient technologies: By utilizing advanced materials and innovative designs, industry products now achieve 18% higher average operational efficiency and 28% lower energy consumption per unit compared to 2024 levels. A prime example is the high-efficiency wear-resistant horizontal double-suction multi-stage centrifugal pump developed by Shanghai Liancheng Group, which has been included in the "2025 Key Promotion and Guidance Catalog for Advanced and Practical Water Conservancy Technologies". This breakthrough effectively meets the stringent requirements of large-scale water conservancy projects for both high efficiency and reliability.

Intelligent O&M Technology: Its core value lies in enabling predictive maintenance and remote monitoring. Solution providers like Skoda are dedicated to offering comprehensive smart equipment monitoring and predictive maintenance services for industrial enterprises, specifically manifested in:

1) Fault prediction: On average, it can forecast equipment failures 14 days in advance, providing ample preparation time for maintenance.

2) Reliable operation: The fault detection accuracy reaches 99.7%, effectively reducing false alarm and missed detection rates.

3) Cost reduction and efficiency improvement: Reduces average unplanned downtime by 35% and maintenance costs by 43% for clients.

4) Predictive maintenance: By leveraging real-time monitoring and AI analytics, it proactively detects equipment failures to minimize downtime.

5) Intelligent Diagnosis: Rapid fault detection and localization significantly improve maintenance efficiency.

Customized extreme-condition technology demonstrates unique value in specialized applications. For instance, the micro ultra-pure centrifugal pump developed by German company Knoll features a compact design with a mere 0.8-liter volume and 1.2kg weight, delivering flow accuracy of ±0.5%. Specifically engineered for ultra-pure medium transportation in 18-inch wafer manufacturing, this innovation signifies a technological leap from conventional manufacturing to precision instrumentation standards.

Corrosion and Wear Resistance Technology: Continuous innovation to meet the demands of special medium processing. In 2025, Germany's ProMinent introduced a new-generation hydraulic diaphragm metering pump featuring a patented PTFE multi-layer composite diaphragm, which offers 40% enhanced corrosion resistance compared to the previous generation and is compatible with highly corrosive media ranging from pH 0 to 14. In the slurry treatment sector, researchers have significantly improved the service life of materials in solid particle-containing media through thermal spraying technology.

4. Industry Applications and Market Reactions

In 2025, diverse application fields will drive differentiated demands for pump technologies, fostering diversified technological development.

In the water and wastewater treatment sector, the growth in global water treatment expenditures has emerged as a key driver, with municipal and industrial water operators accounting for 28.2% of the total revenue in the industrial pump market. The U.S. Environmental Protection Agency (EPA) estimates that long-term remediation needs in this field exceed $744 billion, further accelerating the multi-phase upgrade process.

The petrochemical and chemical industries impose exceptionally stringent requirements on pump technology. In large-scale cracking units, single-stage cantilever pumps are typically employed for lighter hydrocarbon media, while multi-stage radial split pumps are utilized for high-head reformate recycle operations. ProMent, a German manufacturer, has delivered 800 corrosion-resistant pumps to global chemical giants including BASF and Bayer, and has secured 12,000 new clients in high-corrosion environments.

The rapid development of the new energy industry has spurred demand for advanced pump technologies. Emerging sectors such as lithium batteries and nuclear power have seen annual demand growth exceeding 20%, serving as the core growth drivers for the industry.

The hydrogen energy sector has created a new frontier for pump technology. Green hydrogen projects require multi-stage booster pumps made of AISI 316 stainless steel and certified with ATEX regional safety. The pump industry is now facing a critical transition from traditional fluid transportation to advanced energy medium processing.

5. Regional Development Patterns and Differentiated Competition

In 2025, the global pump market will feature a diversified regional competition landscape, with each major region developing distinct strategies based on its unique strengths.

The Asia-Pacific region, especially the China market, has become the core engine of growth for the global pump industry. The scale of China's centrifugal pump market has maintained a growth rate of over 8% for seven consecutive years and is expected to exceed 15 billion yuan by 2025. Chinese pump manufacturers are achieving a strategic transformation from "technological follower" to "comprehensive leader," with the market share of domestic products rising sharply from 60% a decade ago to 92%, and the self-reliance rate of core technologies exceeding 96%.

European enterprises continue to maintain global leadership in precision manufacturing and high-end customization. For instance, Germany's Kono holds a 65% market share in the semiconductor-specific pump sector. European industrial clusters contribute approximately 32% of global pump market revenue, dominating the high-end precision segment.

The North American market primarily targets industrial high-volume applications. Confronted with competitive pressures from low-cost manufacturing regions, North American suppliers are actively strengthening their market position through technological innovation and digital transformation.

6. Future Trends and Challenges in Technology

Looking ahead to 2026 and beyond, the global pump industry is expected to evolve along three key directions while facing a range of challenges.

The trend of technological convergence is intensifying. Future pump technologies will demonstrate deeper integration of electromechanical-hydraulic systems and cross-domain fusion. The combination of artificial intelligence, IoT technologies, and fluid dynamics will give rise to smarter, adaptive pump systems. Taking the hydraulic pump sector as an example, the development of electro-hydraulic units is steering toward more integrated and comprehensive electrification solutions.

Sustainable development demands upgrades. Driven by increasingly stringent environmental regulations, pump remanufacturing and material recycling will become key industry trends. The EU's Circular Economy Directive is boosting revenue growth in related remanufacturing businesses and increasing market demand for pump products that comply with EN ISO 14971 standards and possess eco-design characteristics.

Emerging application fields are continuously expanding. Emerging sectors such as hydrogen energy infrastructure, carbon capture, utilization and storage (CCUS), and advanced energy storage systems are providing a new stage for pump technology. For instance, the Star Pump Alliance has demonstrated a sealed high-pressure pump solution specifically designed for hydrogen production, where this early-stage niche market imposes extremely high requirements on material corrosion resistance and zero-leakage performance.

The challenges facing the industry are becoming increasingly prominent. The sector is simultaneously confronted with multiple challenges, including fluctuations in raw material prices, restructuring of global supply chains, fragmentation of technical standards, and cybersecurity risks. Particularly with the widespread adoption of intelligent pump systems, cybersecurity has emerged as a severe issue that cannot be overlooked.